If you have been in the CRE sustainability world over the last few months, you have probably noticed a trend emerging: any sustainability initiative now has to survive ROI scrutiny, or it will die in the drawer.

This has long been obvious for things like equipment upgrades, retrofits, and solar, and similarly, investments in real time energy monitoring have always been judged based on the ROI they deliver.

But now the scrutiny is coming for everything, even the reporting tools.

A few weeks ago, we ran a survey with sustainability leaders about this. A few conclusions we took away:

- 83% say sustainability no longer moves forward without a clear financial justification or direct return.

- 55% reported that the reporting and data collection process consumes so much time that it prevents project execution.

- 65% believe current reporting platforms consume resources without offering financial return to operations.

- And nearly the same 65% specifically mentioned that reporting platform fees are high and also make it harder to implement other efficiency or decarbonization solutions.

The rules of benchmarking and reporting have changed. What started with automation and then accuracy is now moving toward clear and direct ROI.

Fortunately, utility data is a goldmine, and your reporting platform can pay for itself.

The End of the Free Pass for Benchmarking

Equipment upgrades, building improvements, solar, and other CapEx projects have always been treated as pure investments, and either the business case holds up or the project is dropped.

That’s because these are property level initiatives that have to fit into the investment thesis of the particular asset and fund.

On the other hand, portfolio scale benchmarking has for a long time skated by without having to prove an ROI. After all, it was seen as a bureaucratic necessity and a required cost to meet investor and regulator demands.

But the environment has changed. Between political headwinds, a tighter economic outlook, or whatever the reason, scrutiny on sustainability spend has reached a new level.

Carbon planning is clearly essential, but helping build 10 or 15 year CapEx plans is not the same as delivering ROI today.

In this new paradigm, reporting platforms need to stop being passive data repositories and become active profitability tools.

Even in triple net settings, where owners traditionally have limited control, delivering real financial value becomes the currency required to motivate tenants to share their consumption data.

Let’s talk about a few ways benchmarking and reporting platforms can deliver ROI today.

Energy Procurement

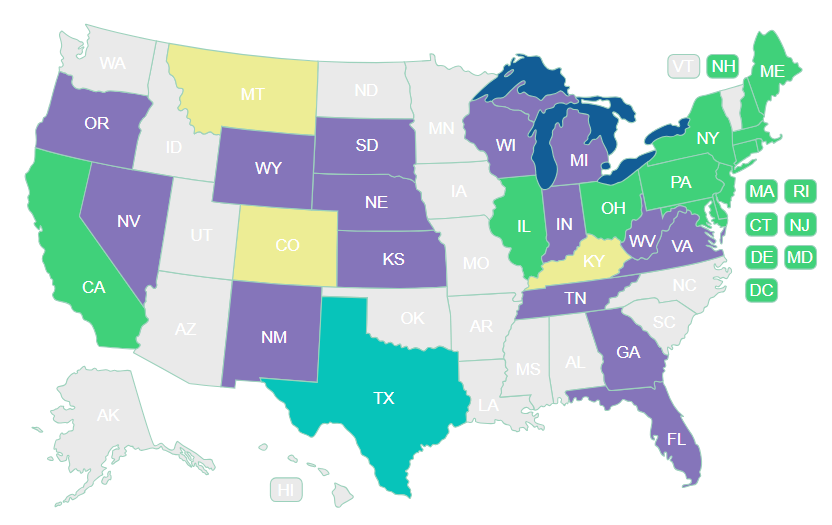

The energy brokerage market is arguably one of the most fragmented in the country. Thousands of small two or three person operations profitably manage a handful of local accounts in a near handcrafted way.

The traditional model is simple: they fix rates, monitor expiration dates in spreadsheets, and call the client when renewal approaches to make sure the contract gets signed.

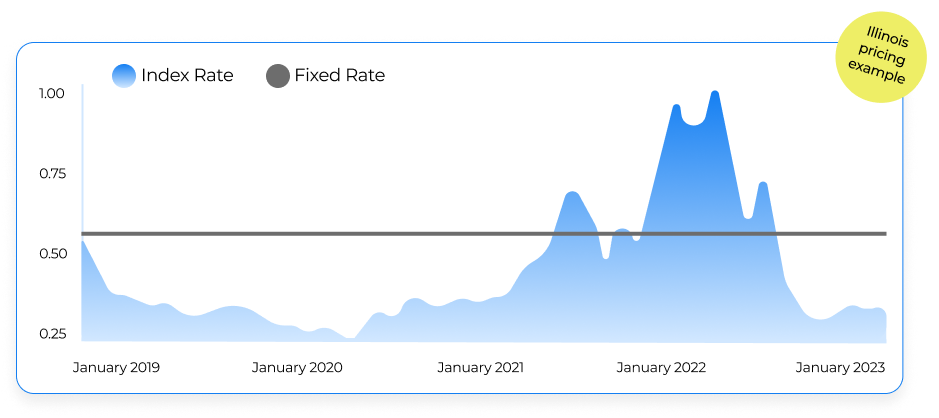

Fortunately, there is a better way. By using granular data and real time market monitoring, you stop being a hostage to the renewal calendar.

Instead of signing a contract simply because the current one is expiring, you can lock rates at the optimal market moment.

You can also blend fixed and floating rates to get the right balance of savings and risk for your situation.

This shift from reactive procurement to a data driven strategy can represent millions of dollars in savings across a portfolio.

Real Example

Enertiv identified a better procurement opportunity for a 900,000 sq ft office building. Through our partnership with Energy CX, which managed the execution of the operation, we were able to deliver $206,718 in annual savings for this single property.

Demand Response

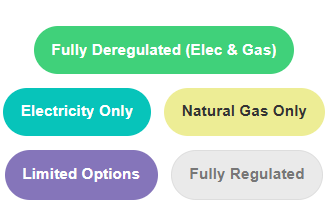

Demand response programs offer direct financial incentives for enrollment and compliance. It is essentially a way to get paid to help stabilize the electric grid when it needs it most.

However, the moment words like curtailment are thrown around, owners and operators tend to get skittish.

The fear of impacting building operations or tenant comfort often stops the initiative before it begins.

But reality is very different from the myth: 99.7% of the time, there is no request to reduce. You are paid to be on standby, not necessarily to shut anything off. In most programs, even if you cannot comply with a reduction event, there is no penalty. You simply do not receive the bonus for that specific event.

The financial upside is massive. We are talking about five and six figure checks that show up for a property for essentially just being in the right program.

If your reporting tool isn’t identifying and quantifying these, you’re missing out.

The Rules of Benchmarking Have Changed

The sustainability journey in real estate has followed a clear maturity path.

First, the focus was automation and the need to eliminate human error and time wasted on manual data collection and cleanup processes.

Then came accuracy, and many platforms realized they were not prepared to handle thousands or millions of hours of data while maintaining quality. It requires a robust process with data quality at the center of everything.

Now we have arrived at ROI on data. In today’s environment, data cannot just be a historical record to fill reports. It must be the engine that generates revenue and makes the program financially viable.

This evolution fundamentally changes the conversation at the executive table.

By turning reporting into a value generator, sustainability stops being viewed as a cost center and takes its place as a pillar of performance.

What else could you fund if your reporting platform paid for itself?